How To add Pages to Bir 1901 Form online?

Easy-to-use PDF software

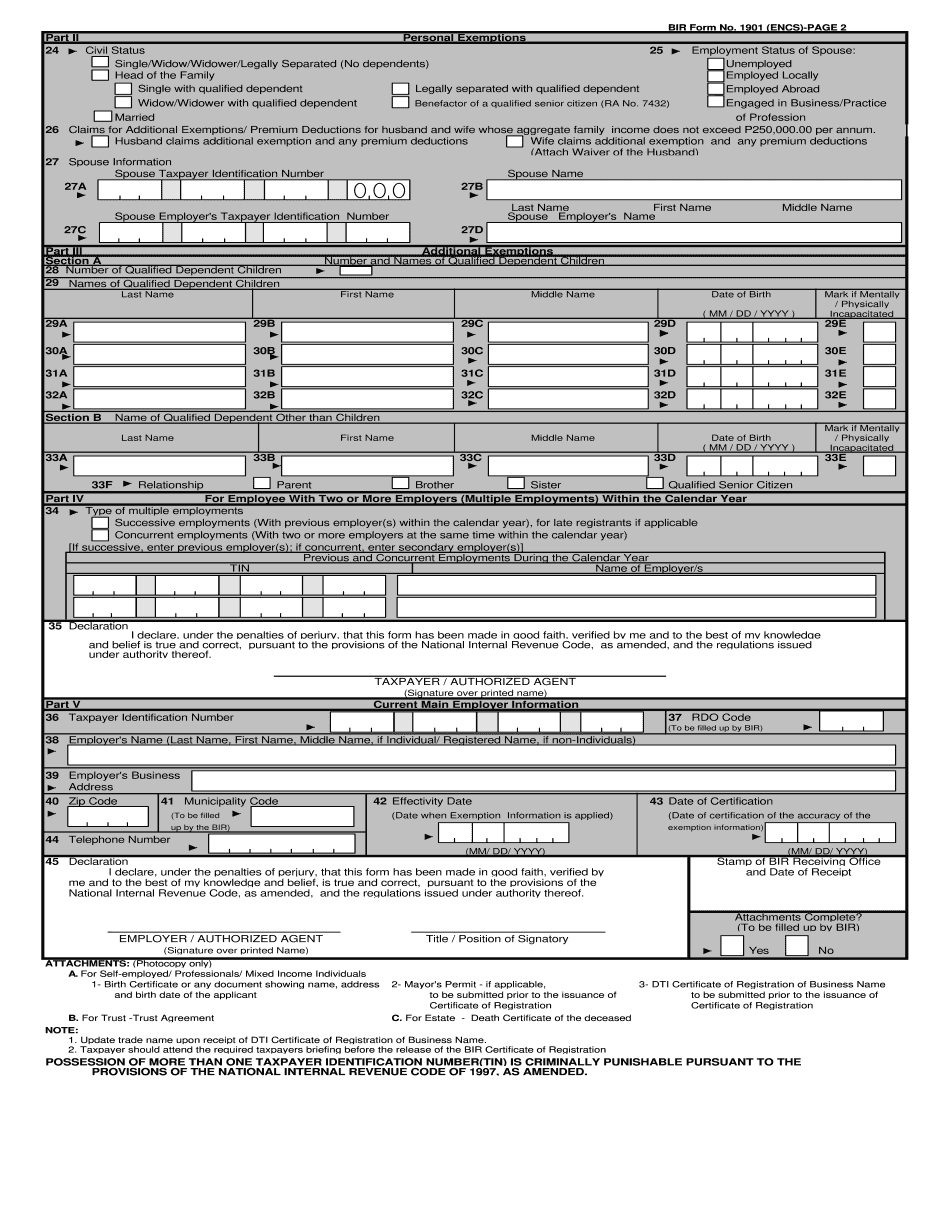

What is Bir 1901 Form?

BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form which summarizes all the transactions made over the tax calendar year.

How to add Pages to Bir 1901 Form

Try out the fastest way to add Pages to Bir 1901 Form without printing. Launch our web-based editor via any browser regardless of your device and operating system. The solution provides you with a full-featured toolkit to simplify and facilitate editing. Look at the step-by-step instructions below and find out how to take advantage of the features:

- Click to start working on your form within an online editor.

- Select any fillable field and enter your information to complete the PDF, or use the Text button to add blocks.

- Utilize the Replace Text option to modify the existing PDF content.

- to enhance the look of your document, add images, annotations, and checkmarks, highlight, erase and blackout content, manage, rotate and merge pages, and so on.

- Place your eSignature and the date.

- Before printing, downloading, or sharing your document, click Done to save the edits.

Feel confident when managing documents via our editor, knowing that the solution is GDPR- and ESIGN- compliant. Prepare your PDF in clicks, add Pages to Bir 1901 Form, modify existing content, and add a new one to cope with red tape using a secure and reliable workflow.

Advantages to Add Pages To Bir 1901 Form here

Our solution helps you work with PDFs hassle-free. Explore the platform capabilities and benefits for a seamless workflow. Boost efficiency and Add Pages To Bir 1901 Form in clicks. Instead of working hard to fix documents, focus on your goals and instantly solve any PDF-related problem. Get rid of annoying bureaucracy and enjoy a robust document turnaround. Manage files, process data, and work from anywhere in the fastest and most straightforward way. Check out the other advantages and find out that the service brings you:

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of Bir 1901 Form?